Dolla dolla bills y'all! Kids & Money

If my kids stay on this path, middle school is going to be more expensive than I thought!

Let me explain:

We pay our kids for their report cards. A's are worth $5 and B's are worth $3. They don't earn money for anything below that. Our thinking is that school is their job when they are kids; it's where they put in hard work to get their education. Just as my husband and I get paid when we work hard at our jobs, we want to reward our kids for their hard work. My PaPa used to do this for me as kid and I loved being able to tell him how many A's I had earned and he LOVED counting out the money he "owed" me.

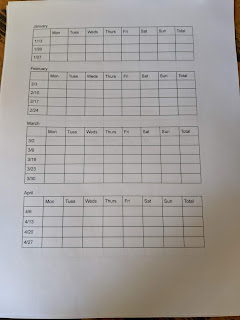

Our kids have always been good students, so they really look forward to report card time. Last year they only received letter grades for 4 classes, but this year at their new school Roy gets letter grades for 7 classes and Stella for 10! And since they both earned all A's and 1 B each, looks like I'll be going to the ATM today... No complaints here.

Here are a few other ways we handle money with our kids:

1. They don't get an allowance. We are able to provide for all of their needs, so I don't see the point.

2. They don't get paid to do normal household chores like cleaning their room, washing dishes or doing laundry. Everyone in a family contributes to the running of that family, so they don't get paid for fulfilling their responsibilities.

3. They can, however, do "extra" jobs to earn some spending money. There are always chores that require a bit more work and time that they can do and get paid for. Things like cleaning all the windows in the house, washing the car, wiping down baseboards or the fronts of the kitchen & bathroom cabinets, etc. I will gladly pay my kids a few bucks to do those things.

4. Any money that they earn or are gifted (like birthday card money from relatives) they pay 10% tithing to our church. We think that it is important for them to understand charity. *And before you ask, yes, the money that is tithed to our church goes to people in need, not to line some church official's pockets*

5. We encourage them to save up for a goal that they really want, but hey get to spend their money however they choose. Which means sometimes they make bad decisions. So when they make a poor choice and choose some piece of crap toy for $3 and it breaks immediately, oh well! Lesson learned!

6. We frequently discuss how much things cost, how long we have to work to earn that particular thing we buy or vacation we take. We don't want money to be a mystery to them or to think that we can just spend it however we want. We feel very fortunate to have gotten to a position where we, as a family, can enjoy good restaurants, travel and experiences together and we do not take that for granted. We want our kids to enjoy the life that we lead without them feeling a sense of entitlement.

7. We have savings accounts for our kids and we encourage them to save money as well. But I also want them to have the joy of buying that bright shiny thing too because none of us is guaranteed tomorrow. Seize the day my love, seize the day!

We want our kids to have a good understanding of how finances work and a healthy "relationship" with money that includes financial literacy AND a good dose of fun. That balance of saving, spending wisely and also enjoying the moment.

Dolla dolla bills y'all.

Let me explain:

We pay our kids for their report cards. A's are worth $5 and B's are worth $3. They don't earn money for anything below that. Our thinking is that school is their job when they are kids; it's where they put in hard work to get their education. Just as my husband and I get paid when we work hard at our jobs, we want to reward our kids for their hard work. My PaPa used to do this for me as kid and I loved being able to tell him how many A's I had earned and he LOVED counting out the money he "owed" me.

Our kids have always been good students, so they really look forward to report card time. Last year they only received letter grades for 4 classes, but this year at their new school Roy gets letter grades for 7 classes and Stella for 10! And since they both earned all A's and 1 B each, looks like I'll be going to the ATM today... No complaints here.

Here are a few other ways we handle money with our kids:

1. They don't get an allowance. We are able to provide for all of their needs, so I don't see the point.

2. They don't get paid to do normal household chores like cleaning their room, washing dishes or doing laundry. Everyone in a family contributes to the running of that family, so they don't get paid for fulfilling their responsibilities.

3. They can, however, do "extra" jobs to earn some spending money. There are always chores that require a bit more work and time that they can do and get paid for. Things like cleaning all the windows in the house, washing the car, wiping down baseboards or the fronts of the kitchen & bathroom cabinets, etc. I will gladly pay my kids a few bucks to do those things.

4. Any money that they earn or are gifted (like birthday card money from relatives) they pay 10% tithing to our church. We think that it is important for them to understand charity. *And before you ask, yes, the money that is tithed to our church goes to people in need, not to line some church official's pockets*

5. We encourage them to save up for a goal that they really want, but hey get to spend their money however they choose. Which means sometimes they make bad decisions. So when they make a poor choice and choose some piece of crap toy for $3 and it breaks immediately, oh well! Lesson learned!

6. We frequently discuss how much things cost, how long we have to work to earn that particular thing we buy or vacation we take. We don't want money to be a mystery to them or to think that we can just spend it however we want. We feel very fortunate to have gotten to a position where we, as a family, can enjoy good restaurants, travel and experiences together and we do not take that for granted. We want our kids to enjoy the life that we lead without them feeling a sense of entitlement.

7. We have savings accounts for our kids and we encourage them to save money as well. But I also want them to have the joy of buying that bright shiny thing too because none of us is guaranteed tomorrow. Seize the day my love, seize the day!

We want our kids to have a good understanding of how finances work and a healthy "relationship" with money that includes financial literacy AND a good dose of fun. That balance of saving, spending wisely and also enjoying the moment.

Dolla dolla bills y'all.

Comments

Post a Comment